We improve tax Alpha and investment Alpha.

Because markets go up and markets go down, one of the best ways to quantify the effectiveness of tax management is by utilizing Tax Alpha and Investment Alpha

When markets are rational and efficient, staying close to a target asset allocation and having a long-term focused plan is paramount. Avoid short-term thinking, emotional investing and market timing. Those are ineffective and non-sustainable.

During irrational moments , information and access to unique opportunities are not accessible by the broader investors.

Investors who have access will be able to generate excess returns if they are able to invest in these stressful moments.

For markets that are rational, invest in risk factors that are persistent and empirical

For markets that are irrational and inefficient, invest in alternative strategies that take advantage of this

Our Investment philosophy reflects the unique perspective we have as an investment advisor that spans multiple asset classes and familiarity with estate planning

- Client investment objectives are often motivated by taxes and stewardship of resources

- Client investments are frequently designated for giving or to support a mission or charity, which necessitates protection against market volatility

- Create Bespoke Solutions to meet client needs

Tax-Efficient Charity

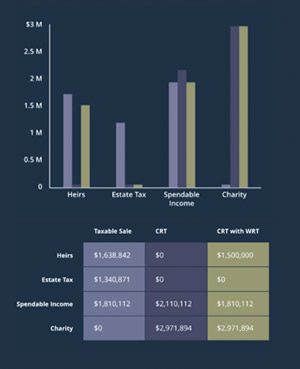

As a result of implementing a Charitable Remainder Trust, the Smiths created a source of guaranteed income for their retirement while dramatically reducing their current income tax liability. They established a tax-advantaged fund for their favorite charities while creating an inheritance for their children and grandchildren that will pass estate tax free. This planning fulfilled the following goals:

- Reduced federal estate taxes

- Funded favorite charities

- Generated an income tax deduction

- Protected assets from creditors

- Diversified their assets tax-free

- Maximized tax-free compounding

- Managed the timing of taxable income

The Smiths lowered taxes by $1,341,000 while improving lifetime income and benefits for heirs. Planning costs were less than 1% of tax savings.

Providing Financial

Solutions for Over 40 Years